A number of key housing market reports have come out over the past week, and they’re giving more evidence to the belief that the nation’s housing market is at long last gaining some solid momentum as summer gets underway.

This week the Commerce Department reported that sales of newly built homes rose in May to the highest level since the recession. New-home sales increased 2.2% over the month to an annual rate of 546,000. That marked the best month of sales since February 2008, and it followed an 8.1% surge in sales in April.

Although purchases of new homes are only about a tenth of all home sales, the report comes amid a other signs that home buying in general is on the rise, thanks to stronger job growth, wage increases, historically low mortgage rates and a gradual easing of lending requirements.

This week’s report on new home sales follows an encouraging report last week that sales of existing homes, which comprise the bulk of the housing market, rose last month to the highest level since late 2009, according to the National Association of REALTORS®.

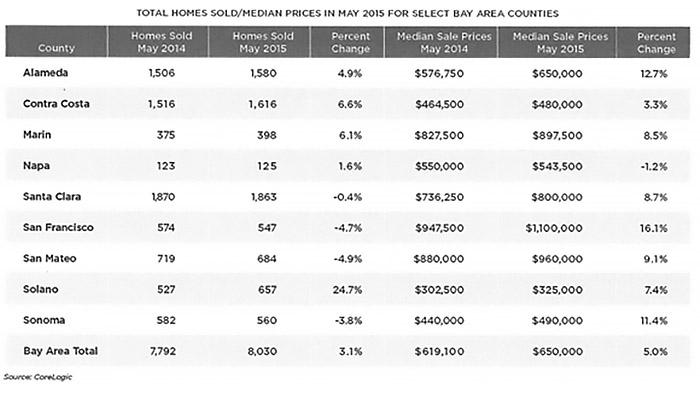

Closer to home, CoreLogic, the real estate information services company, reported that new and existing home sales in the Bay Area rose 3.1 percent last month from a year ago. The greatest increase came in Solano County, which saw a 24.7 percent jump, followed by Contra Costa County with a 6.6 percent increase and Marin County with a 6.1 percent rise.

The Bay Area median sale price meanwhile climbed 5 percent year over year to reach $650,000, according to the Irvine-based research firm. San Francisco led the way with a 16.1 percent spike in the median price to $1.1 million. Alameda and Sonoma Counties also had a double-digit increase in their median sale price.

The Bay Area home sales and median price chart is below, followed by market-by-market reports from our local San Francisco Bay Area offices:

North Bay – Agents are still seeing full multiple offers on good properties, but they are also seeing price reductions and properties, including Previews luxury listings, staying on the market longer. Our Novato manager says the market is a little quieter in Northern Marin. Sales activity is steady but with graduations and summer vacation the market seems calmer. Agents are still very low on listing inventory but are finding a way to get buyers in contract with limited choices. Some homes are sitting for a few weeks and then experience multiple offers. Buyers don’t know how to act unless competing! Not too many million-dollar homes have sold in Novato area in the past week or two. Our Santa Rosa Mission office manager says agents are still dealing with limited inventory with some signs that the market is shifting to more balance between buyers and sellers. Still red hot are retirement communities that are well located to conveniences. The market for Previews type luxury properties is robust and outpacing the broader market in unit and volume sales. Our Sebastopol manager reports that well priced listings continue to fly off the shelf. The overall southern Marin County market is still constricted by limited inventory. The best properties are still experiencing an extreme seller’s market. For example, our local office listed a remodeled property for $1,799,000 and it received multiple offers. The winning bid was $2,250,000 ($451,000 over) all cash, no contingencies, close in 3 days. This resulted in a record-breaking price per foot for the neighborhood of $1,079. The luxury market remains strong and steady. The Previews market has leveled off as evidenced by our last four listings over $2 million that have received offers below the asking price. Sellers are now pricing their properties at the multiple offer overbid prices. This is causing less demand and offers below asking. More competitive pricing is still the best strategy.

San Francisco – Buyers appear cautious but ultimately seem to follow the crowds to popular well priced listings, according to our San Francisco Lakeside office manager. Some sellers are finding they will have to “accept” their list price if they actually want to sell. Our Lombard office manager says the last couple of weeks saw fewer offers per sale, and prices over, but closer to the asking price. An encouraging slight bump in inventory one week sees a drop the next, or an increase in sales, keeping inventory slightly over one month. More properties are either flawed or over-priced and are getting stale or even seeing price reductions. With the exceptions of new construction and a pre-emptive offer, all properties that ratified this period received multiple offers, reports our Market Street office manager. Even so, there’s a sense that buyers are starting to focus on summer activities that don’t include house hunting. Agents are seeing the number of multiple offers decline, and some listing agents are “dialing for dollars” due to concerns that no offers will come in. Agents have even seen a handful of properties with price reductions. Is this a new trend? The general feeling is no, and that we’re just experiencing the City’s usual summer slowdown. In either case, it could be a good opportunity for buyers to buy a home without the intense frenzy of the past months.

SF Peninsula – Our Burlingame manager says the story isn’t much different for all towns on the Peninsula. Prices are being bid way up by buyers anxious to get into just about anything to be in this area. Open homes are just packed with the turnaround from list to sale in less than 2 weeks. Hillsborough has only 21 active listings and 20 pending sales. With inventory this low and so few choices for buyers, this market is tighter than ever. Our office has put four large sales into escrow in the last week ranging from $5-13 million, which demonstrates the strength of the upper end market very dramatically. Our Burlingame North manager doesn’t know if it’s a trend, but he’s reviewed several contracts this past week in the $1-2.5 million +/- range that sold with multiple offers and none of them were all cash. There was financing in roughly the 70% LTV or lower range. A few even had one short period contingency. The contingencies would either be financing, appraisal or property condition, but again about 7-10 days max. From May 1 through June 24 there were 65 homes that closed in San Mateo County with a list price at $3,000,000 or above. In Half Moon Bay, Still struggling with lack of inventory and buyers losing out on multiple offers. In Montara, Moss Beach, El Granada, and Pescadero, there are currently 44 active single family homes for sale. Nine of them are below $1 million. Our Menlo Park manager says the market is holding steady but definitely some sellers are pushing up their prices and getting some buyer resistance. The Palo Alto market has seen a fantastic two weeks of increased volume. Even though it is a sellers’ market, convincing the sellers to sell is not an easy task, says our Redwood City-San Carlos manager. Where will we go? Our taxes will be higher. There are just a few of the comments. There still are multiple offers on most properties. It’s a very challenging time. Even with Dad & Grads, and the start of summer, the San Mateo area market is still strong. Agents are seeing multiple offers on most of their listings. The Woodside-Portola Valley market is slower, definitely. Our local manager says it may be seasonal as the richer this area becomes, the more it clears out during almost the entire summer. It may be price fatigue – she suspects we will see resurgence after Labor Day. Entry level from San Mateo through Mountain View for a very basic 3/2 house is $1.5 mil. We still need more property even in the higher end in PV and Woodside.

East Bay – Properties priced under $800k are still receiving multiple offers, according to our Berkeley manager. Interest rates are still at an all-time low and buyers are willing to pay high prices to win. Not seeing 20-30 offers on homes this month but still 7-10 offers and 20-30% over asking. Open houses are still heavily attended. Most buyers are coming from San Francisco who can afford up to $1.2m. Houses priced in the high end are seeing offer dates come and go. Some agents are taking offers as they come. June and July are typically slower months for the real estate market. The Danville area market is still very active, however it is becoming more house-specific with regard to multiple offers and over-bidding. Some Sellers are upset if they “only get one offer” or it takes a couple of weeks for the home to sell. Agents’ current challenge is managing sellers’ expectations. This past Father’s day weekend proved to be a little slower for open house activity, according to our Oakland-Piedmont manager. There is small shift in the market frenzy. Prime houses are still going way over but more buyers are taking a step back and slowing down their purchasing process. The number of offers received in most cases is down to the 4 – 5 range instead of double digits and there are some properties that are going for list price or a little under. The consensus of agents is that it’s the typical summer slowdown.

Silicon Valley – Things are definitely slowing down, our Cupertino manager reports, and it’s probably due to the summer season. In Los Altos Hills there still is a lot of high end inventory over $5 million. Although anything under $3M is selling right away unless the slope is over 40%. Of course the Palo Alto school district in Los Altos Hills is a permanent draw. In Los Altos, there is more than four months of inventory above $5m., but everything else flies off the active list in one week. A teardown house in middle Los Altos on 13,000 sq ft odd shaped lot was listed at $2.2 and sold for about $2.9. Still lots of pent up demand for any entry-level inventory, and those listings get multiple offers. Prices do not seem to be climbing now, but if listed at the sale price, then little to no offers the first week. If the house is underpriced, then the buyers all want it. Mountain View still doesn’t have enough inventory in either single family residences or condo/townhouse. All inventory seems to disappear in a week, unless the price is over the market value. Sunnyvale & Cupertino still doesn’t have enough inventory, but overpricing will not sell the house. Still multiple offers on any houses price under fair market value. In the Los Gatos area, buyers are beginning to show fatigue as prices continue to rise. Listings and sales are continuing to be strong across all price points in the San Jose Almaden area. Agents are still seeing multiple offers but not as many offers with zero contingencies across the board. They are still waiting for the “summer slowdown,” but it hasn’t started. Willow Glen continues to see limited growth in new inventory. The market seems to be stagnate at 60 active listings. Demand has tempered a bit. It might be the seasonal July 4th holiday week. Some Saratoga agents have shared that they’ve noticed a cooling off on the number of showings and multiple offers. Open houses have slowed as well. Is this seasonal or have buyers reached the tipping point of affordability? We did hear of a 2/2 townhome in Mountain View selling off market: List price was $1.2 million. A buyer offered $1.5 million all cash and the seller took it. That doesn’t sound like it’s cooling off any, our Saratoga manager says.

South County – In baseball terms, the “June Swoon” is often used to describe a team’s slump. The South County real estate market is definitely in its own “ June Swoon” as well. It seems that almost every aspect of real estate has significantly slowed down—less activity at open houses, fewer listings AND lower sales. Agents are also reporting that they are witnessing some sellers actually lowering their prices to garner an offer—a phenomenon that has not occurred for quite some time. Though the market remains viable and strong, and well-priced, nicely appointed homes sell fairly quickly, others are remaining on the market and will require further price adjustments.

Monterey Peninsula – Our local offices had a strong month for June with several significant sales in the $3 million plus price point and one off market at $9 million in Carmel. Summer is here and the out of area homeowners have arrived escaping the valley and Southwest/Texas heat. This has become a large group of current homeowners and future homebuyers. The Pacific Grove market under $1 million is still incredibly active with multiple offers on most new listings. Open houses have been well attended by neighbors considering selling. Like most areas now is the time to list and sell your property while the market is hot.